In September and October we will be featuring blogs from Kevin Hannah Q.C. on division of property. Kevin is sharing his expertise, and hopefully more fishing metaphors, to help shed some light on this important family law issue.

50/50. Simple, right? Not really. But I’ve been told many times – usually by the husbands – that it is simple. They seem to know an awful lot about property law and divorce.

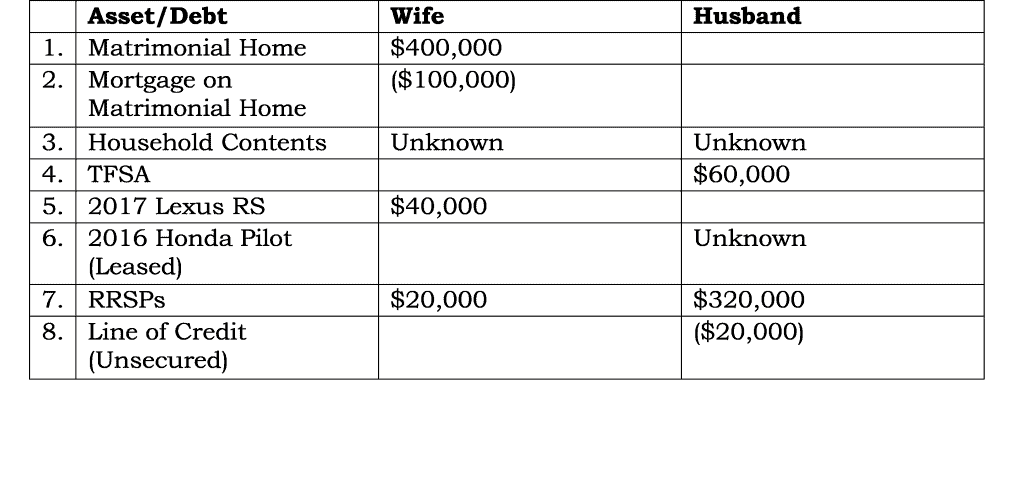

Take one of the simplest of property divisions on divorce. Husband and wife own a vehicle each, an RRSP each, the husband has a Tax Free Savings Account, and there is one home they own in joint names and lived in throughout the marriage and a line of credit. The husband took about half of the furniture when he moved into an apartment about six months ago.

The summary looks like this (assuming each keeps the asset or debt in their column):

With this division of the assets and debts some of you (probably husbands) decided that it was even. The husband and wife, adding their respective assets and subtracting their debt, each had a net worth of $360,000. If they each keep what they have, it’s a wash. No one owes the other a payment. Go your separate ways!

Not so fast. If each keeps what they have and walk away with no one making an adjusting payment to the other, the husband gets the short end of the stick. They ignored the student loan of $30,000 the wife came into the marriage with and which the husband paid off. The law in some provinces treats pre-marriage debt as not divisible and a credit in some cases. They treated the RRSPs of the husband as being net of tax, like the equity in the home, which they are not. The moment the husband cashes an RRSP he must pay tax in that year so what he is left with is much less than the total on paper. His $320,000 in RRSPs is worth much less than $300,000 equity in the home, even with costs of sale factored into the home. And what about the leased Honda Pilot? Is it to be valued as an asset or a liability?

Big Picture Property Division Principles:

But these relatively simple principles are subject to many exceptions, other principles and qualifications in the law. If you do not know what they are, you can save a few thousand in legal fees and negotiate your property division without legal advice and end up losing tens or hundreds of thousands of dollars compared to a settlement done with legal advice. Please contact us for more information.